Market Regime Detection for Probabilistic Trading

Market Regime Detection for Probabilistic Trading

RiskCurve — Mastering probability. Respect risk.

RiskCurve — Mastering probability. Respect risk.

RiskCurve delivers market regime detection, volatility regime analysis, and probabilistic trading context so traders operate only when statistical advantage exists.

RiskCurve delivers market regime detection, volatility regime analysis, and probabilistic trading context so traders operate only when statistical advantage exists.

Early-stage product · Help shape the platform · No signals · No hype

What is market regime detection?

What is market regime detection?

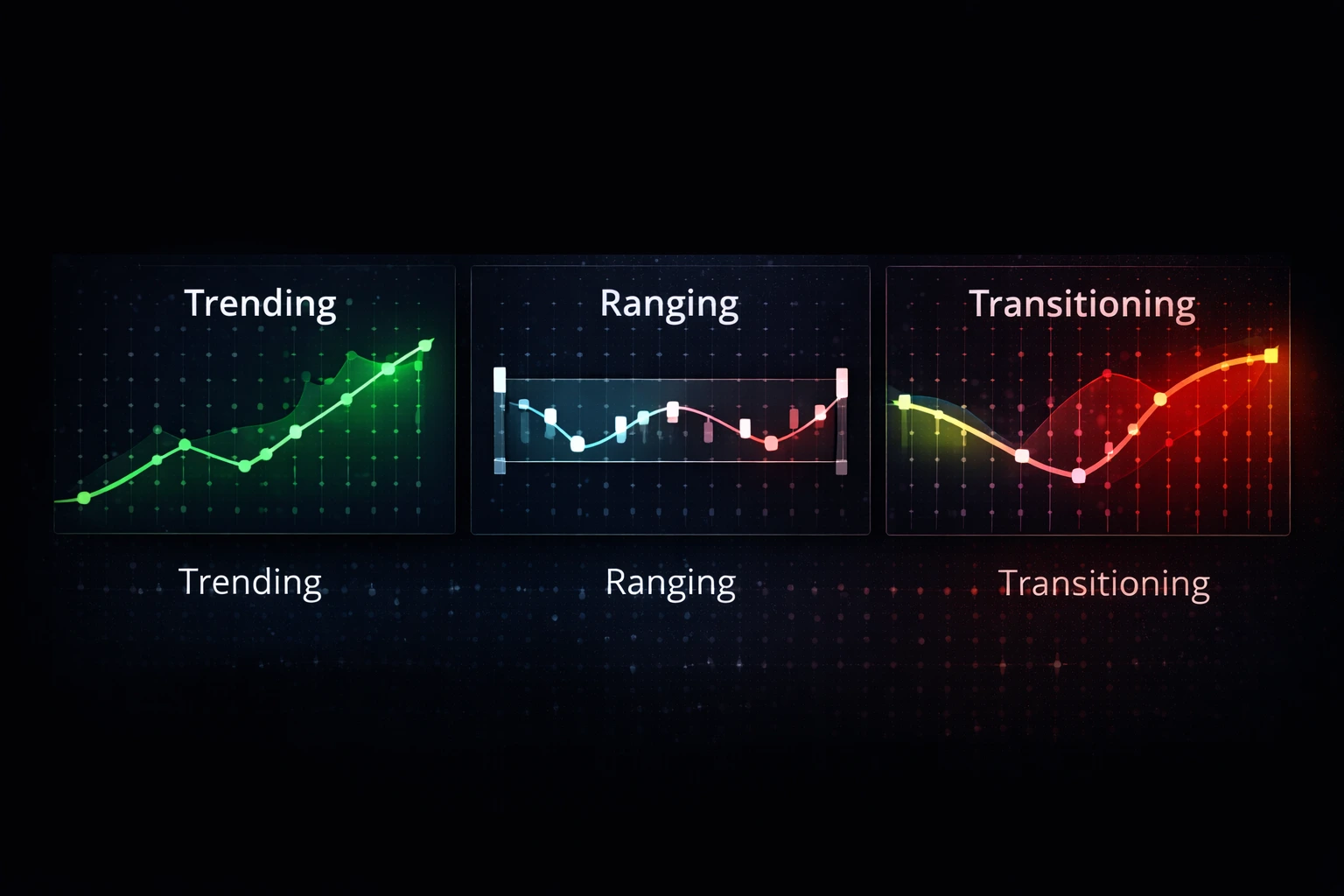

Market regime detection is the process of identifying whether a market is trending, ranging, or transitioning between states. Different regimes favor different strategies — ignoring regime context often leads to drawdowns.

RiskCurve models market regimes using probabilistic methods and deep learning to provide stable, actionable context for traders.

Market regime detection is the process of identifying whether a market is trending, ranging, or transitioning between states.

Different regimes favor different strategies — ignoring regime context often leads to drawdowns.

RiskCurve models market regimes using probabilistic methods and deep learning to provide stable, actionable context for traders.

Market regime detection is the process of identifying whether a market is trending, ranging, or transitioning between states. Different regimes favor different strategies — ignoring regime context often leads to drawdowns.

RiskCurve models market regimes using probabilistic methods and deep learning to provide stable, actionable context for traders.

Built for the trader who…

Trades with a defined strategy

You’ve moved past "guessing" and want a platform that respects a rule-based approach.

Trades with a defined strategy

You’ve moved past "guessing" and want a platform that respects a rule-based approach.

Prioritizes drawdown control:

You value your capital and understand that elite performance starts with a strong defense.

Prioritizes drawdown control:

You value your capital and understand that elite performance starts with a strong defense.

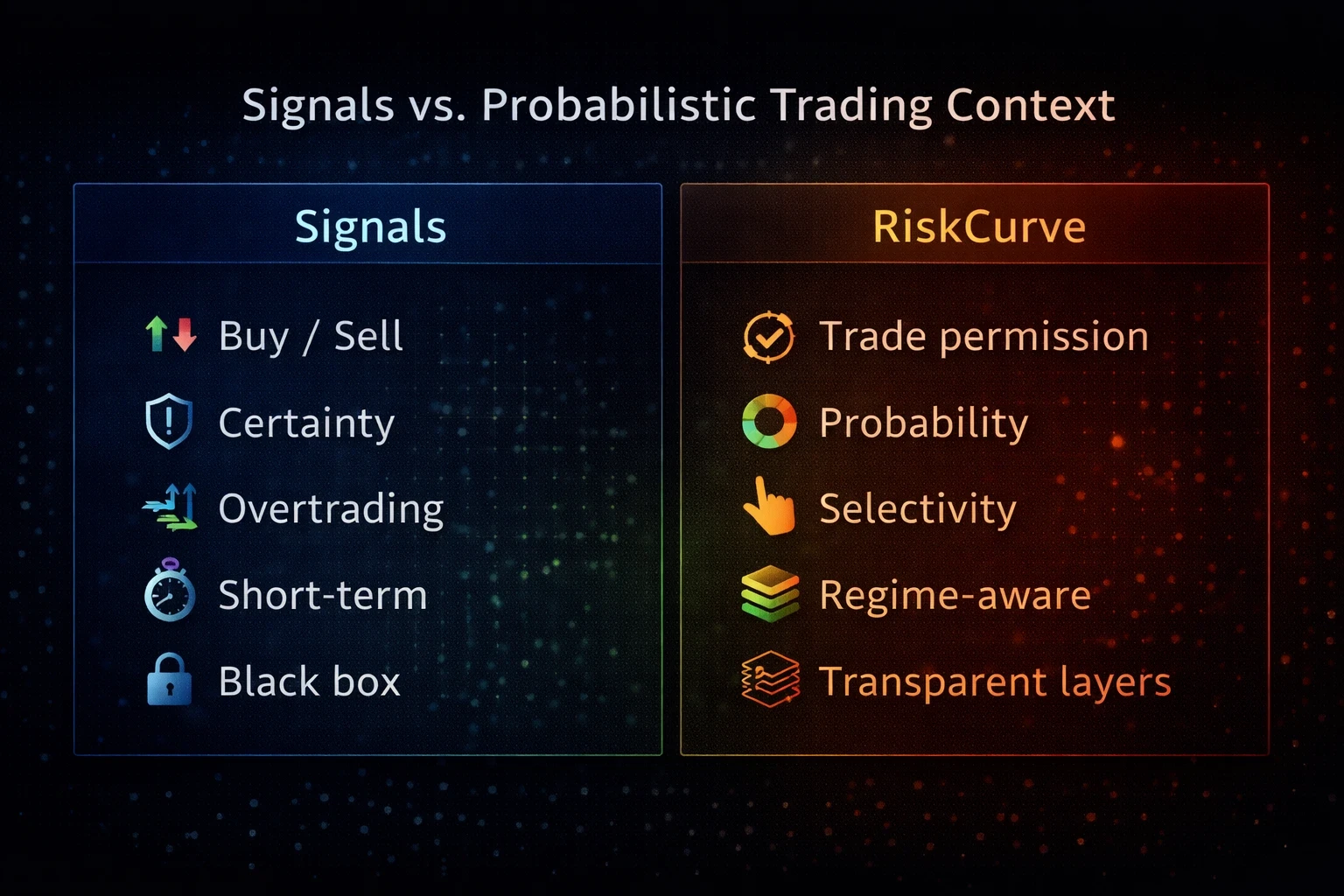

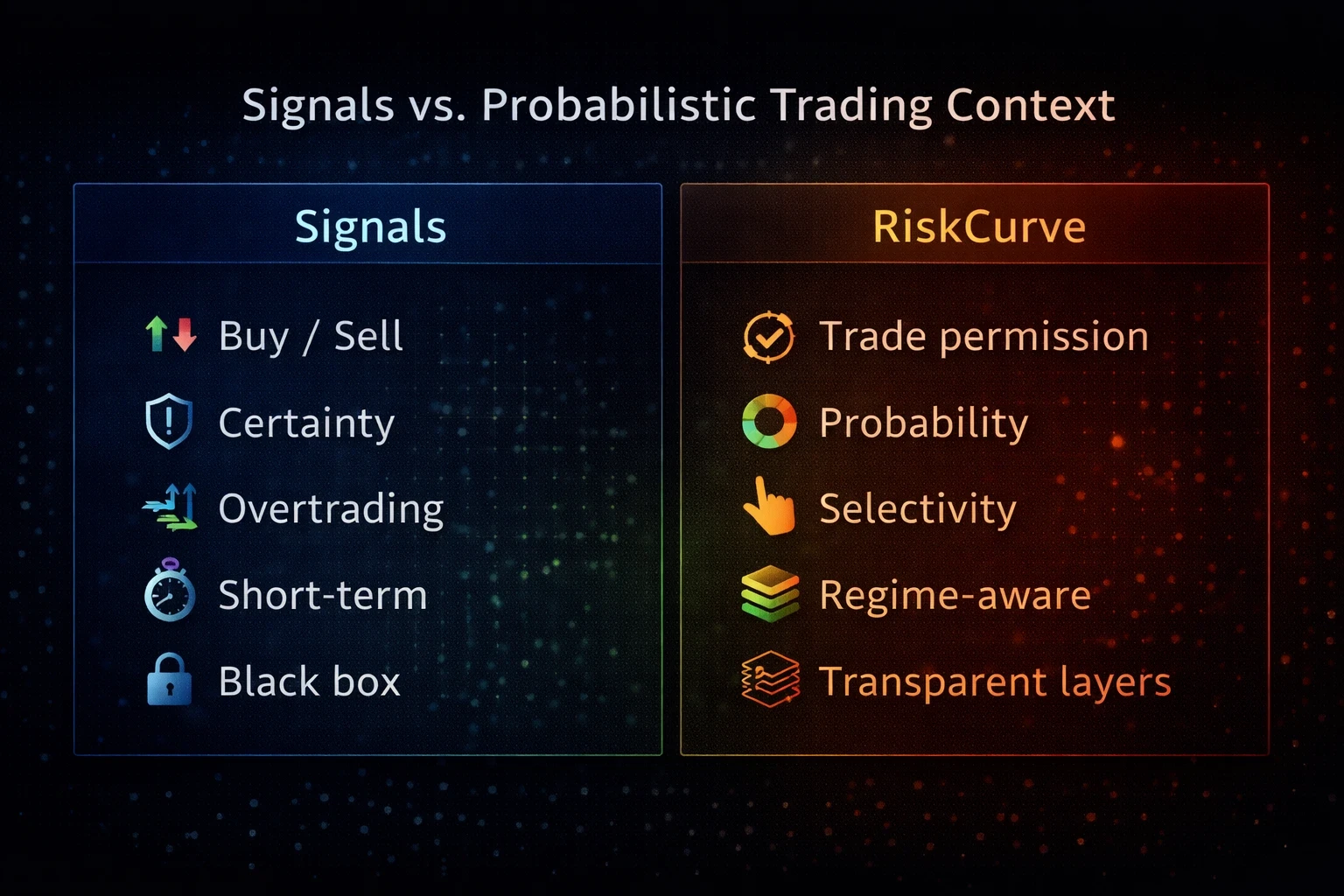

Thinks in probabilities, not certainty

You’ve outgrown the hunt for "signals" and now focus on the math of a winning edge.

Thinks in probabilities, not certainty

You’ve outgrown the hunt for "signals" and now focus on the math of a winning edge.

Prefers selectivity over frequency

You have the patience to skip the noise and wait for the setups that actually matter.

Prefers selectivity over frequency

You have the patience to skip the noise and wait for the setups that actually matter.

Not a signal service · Not a trading bot · No guaranteed profits

Not a signal service · Not a trading bot · No guaranteed profits

Built for the trader who…

Trades with a defined strategy

You’ve moved past "guessing" and want a platform that respects a rule-based approach.

Prioritizes drawdown control:

You value your capital and understand that elite performance starts with a strong defense.

Thinks in probabilities, not certainty

You’ve outgrown the hunt for "signals" and now focus on the math of a winning edge.

Prefers selectivity over frequency

You have the patience to skip the noise and wait for the setups that actually matter.

Not a signal service · Not a trading bot · No guaranteed profits

Stay informed on RiskCurve

Sign up for early access

Stay informed on RiskCurve

Sign up for early access

Stay informed on RiskCurve

Sign up for early access

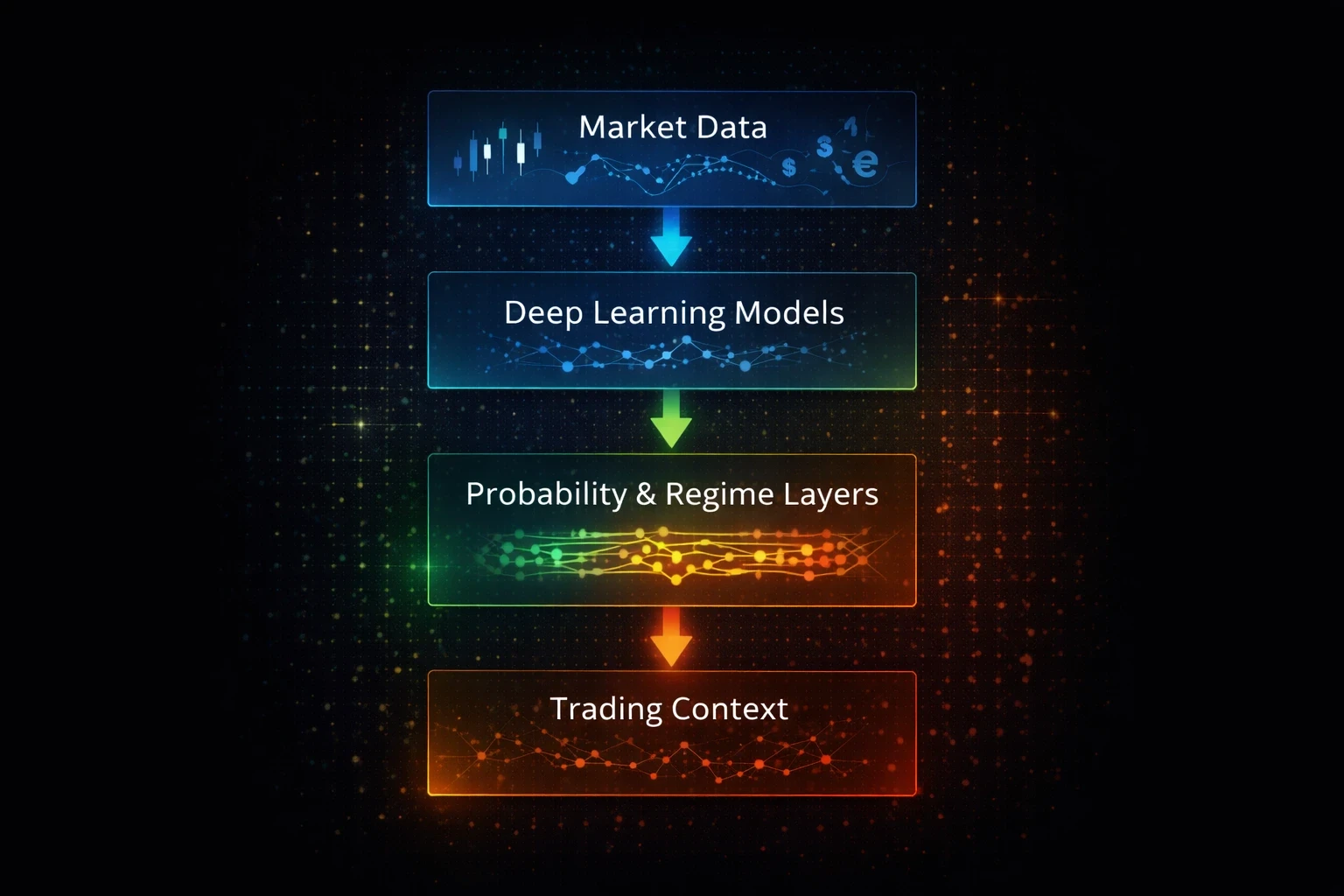

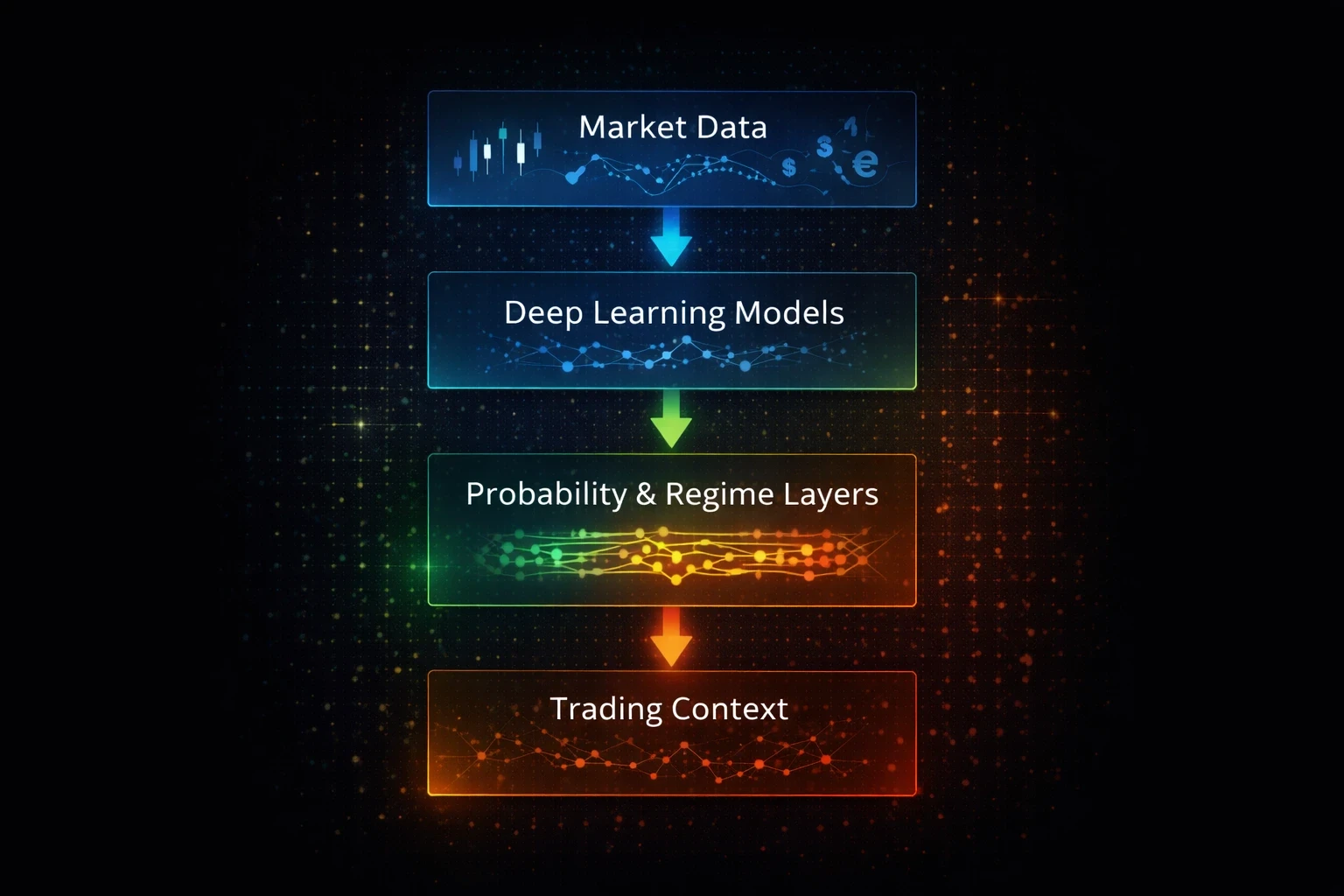

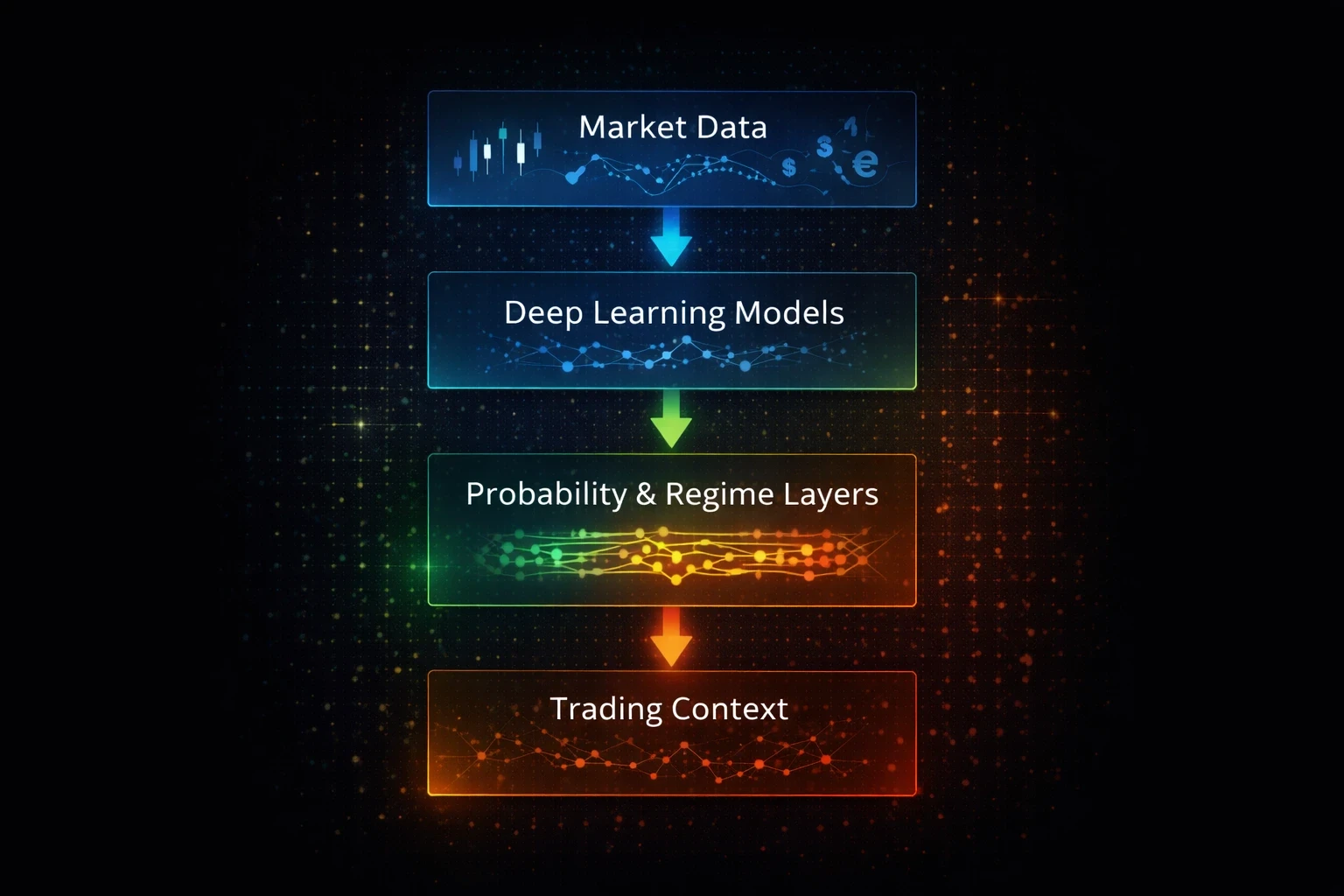

How It Actually Works…

How It Actually Works…

How It Actually Works

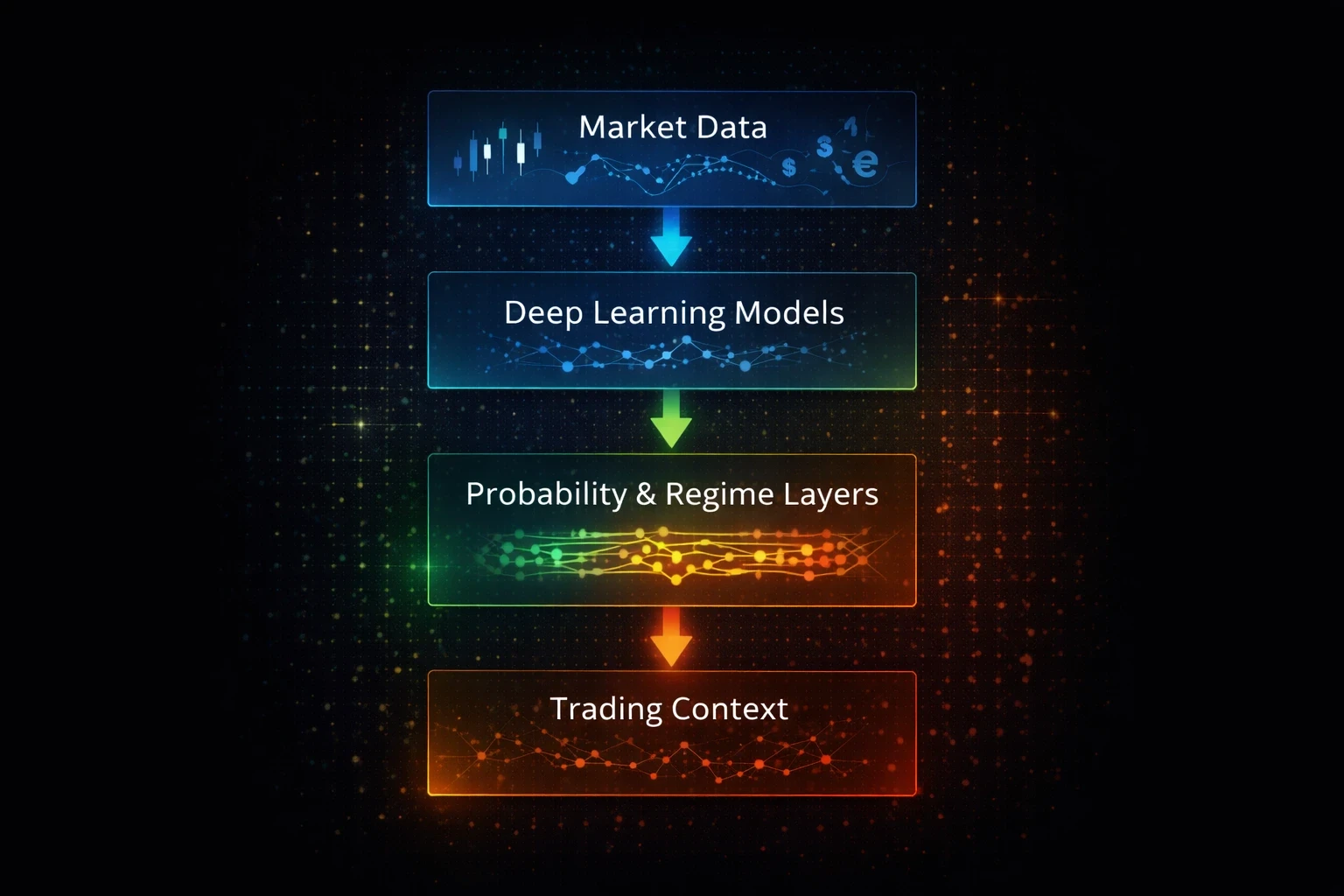

RiskCurve uses LSTM models to understand how market conditions evolve over time, which is crucial because trading success depends on recognizing when patterns persist and when they change.

RiskCurve does the heavy lifting by blending complex macro trends and chart data into a single, easy-to-read map of market risks.

RiskCurve uses LSTM models to understand how market conditions evolve over time, which is crucial because trading success depends on recognizing when patterns persist and when they change.

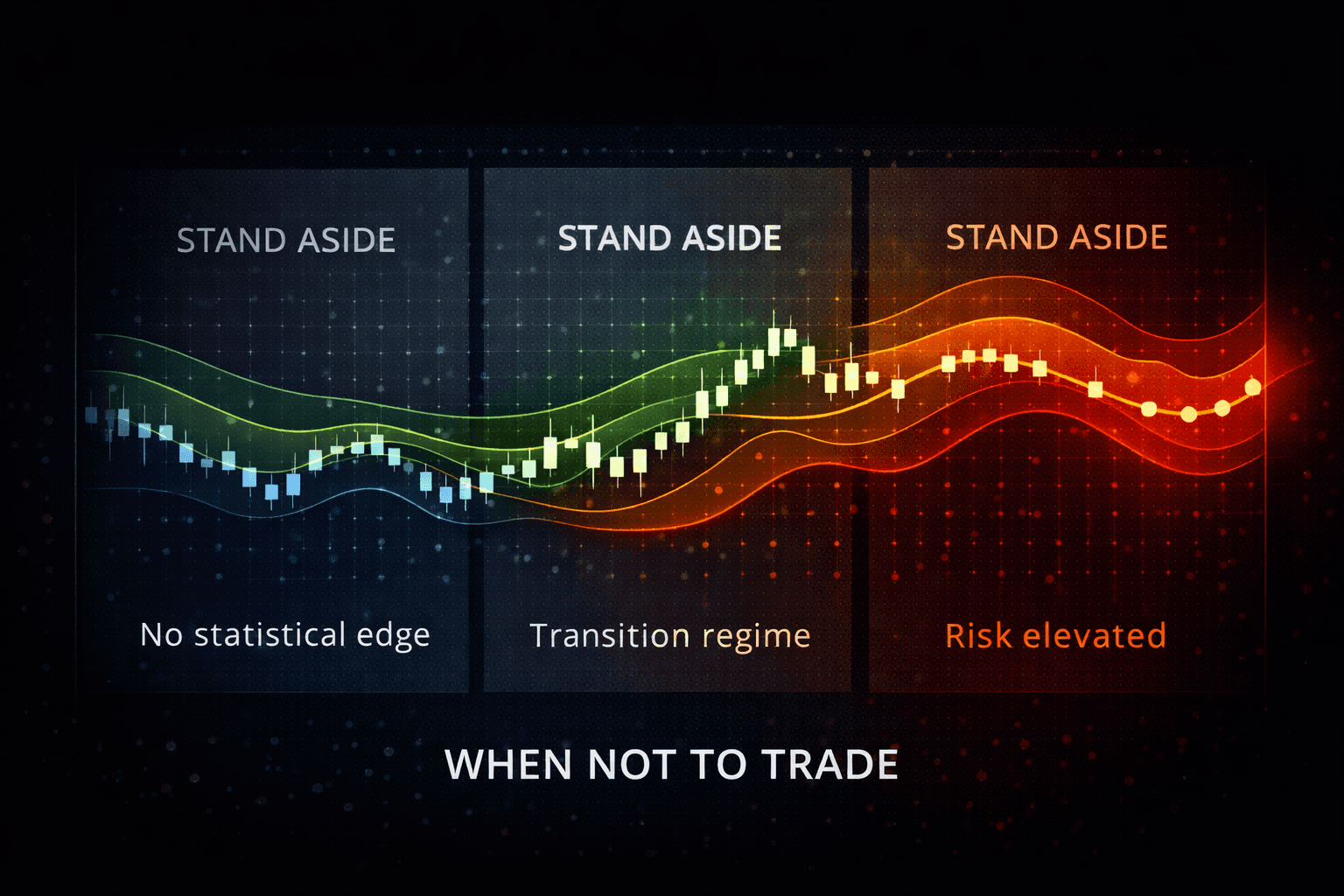

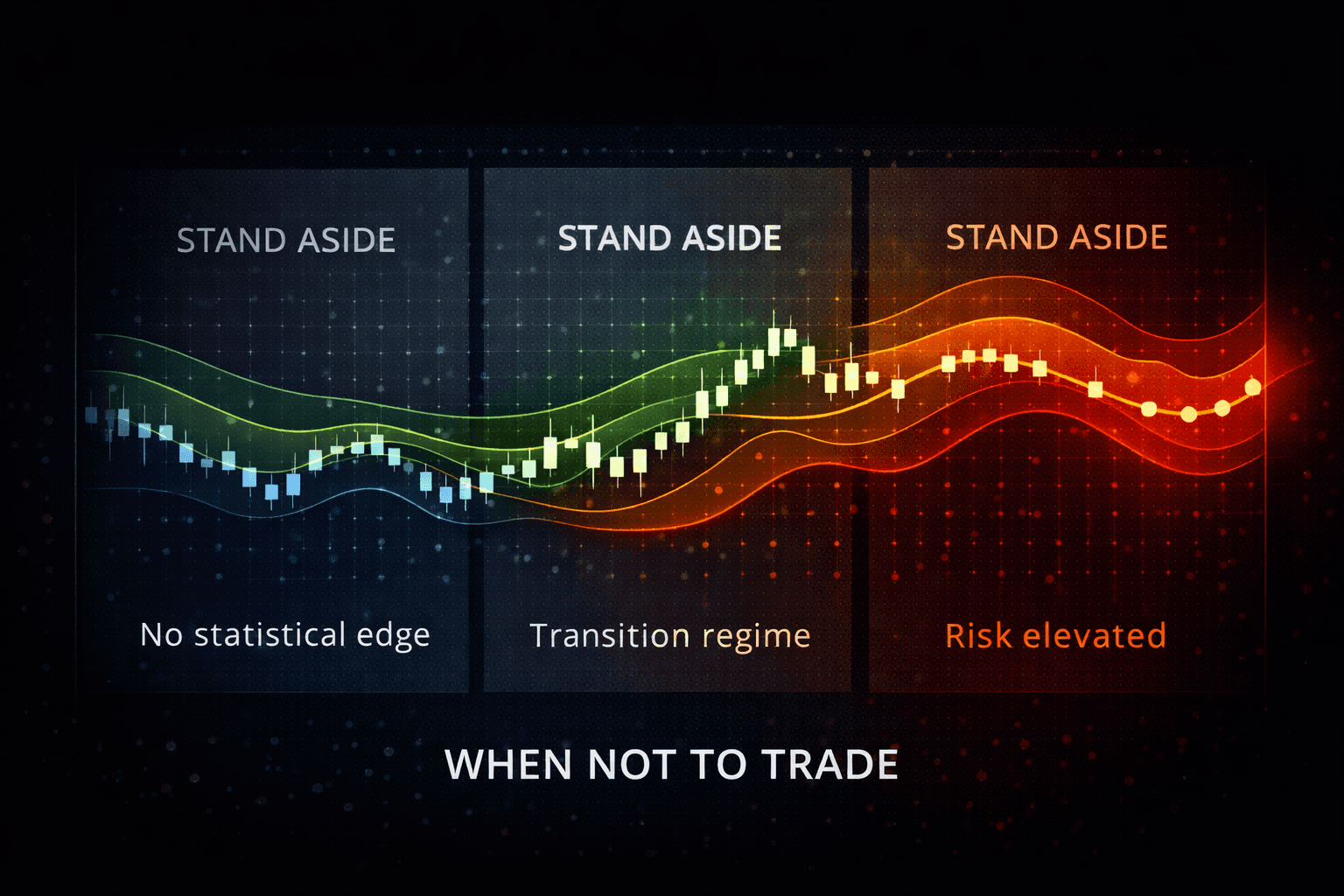

Most strategies fail in the wrong conditions

Most strategies fail in the wrong conditions

Most strategies fail in the wrong conditions

Even strong strategies break when:

Even strong strategies break when:

volatility regimes shift

volatility regimes shift

volatility regimes shift

macro pressure dominates

macro pressure dominates

macro pressure dominates

markets transition from trend to range

markets transition from trend to range

markets transition from trend to range

risk increases silently

risk increases silently

risk increases silently

Probabilistic trading context instead of signals

Probabilistic trading context instead of signals

Probabilistic trading context instead of signals

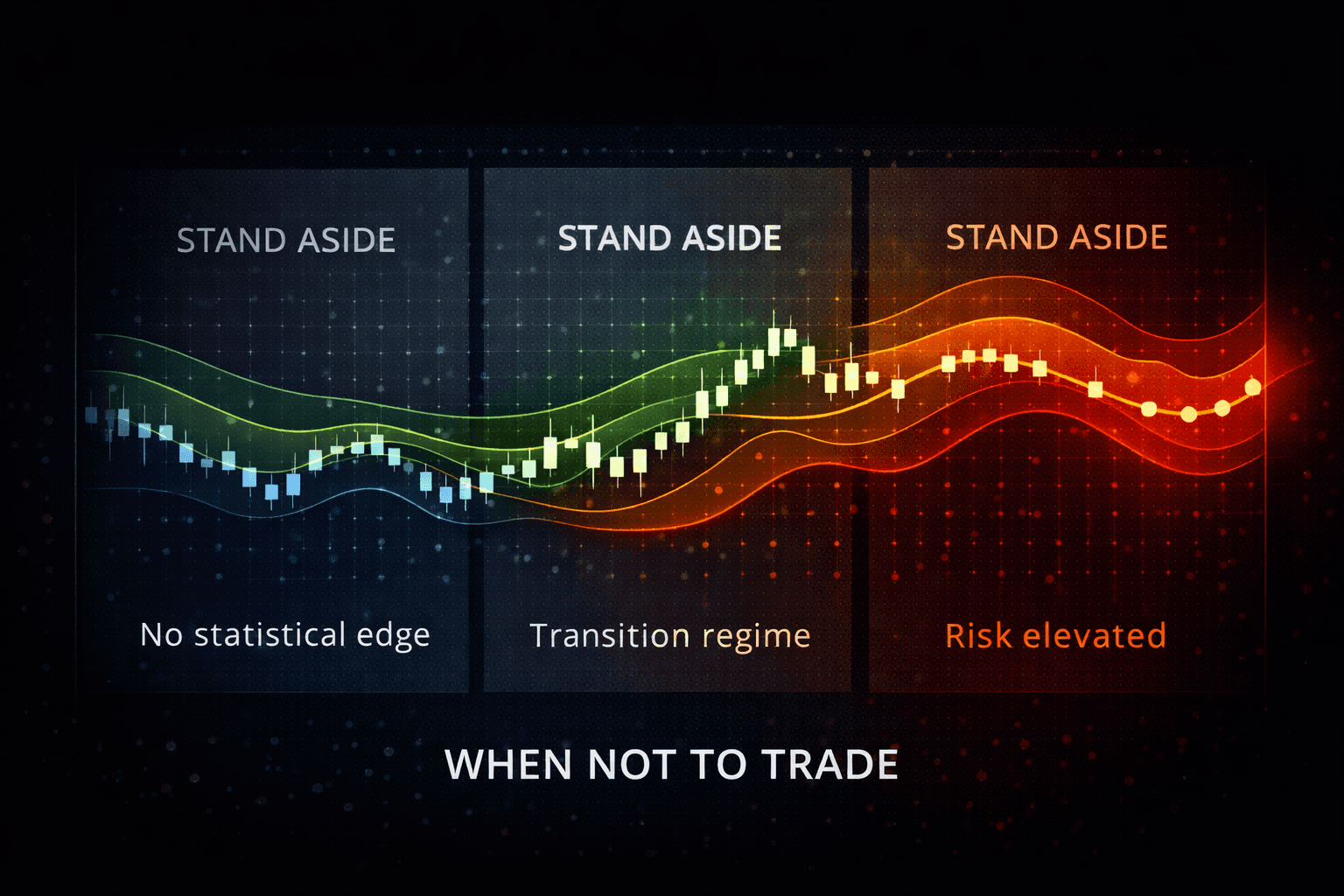

Probabilistic trading focuses on understanding when market conditions are favorable rather than predicting exact price movements.

Probabilistic trading focuses on understanding when market conditions are favorable rather than predicting exact price movements.

Probabilistic trading focuses on understanding when market conditions are favorable rather than predicting exact price movements.

RiskCurve delivers probability-based regime, volatility, and risk context — allowing traders to decide when not to trade.

RiskCurve delivers probability-based regime, volatility, and risk context — allowing traders to decide when not to trade.

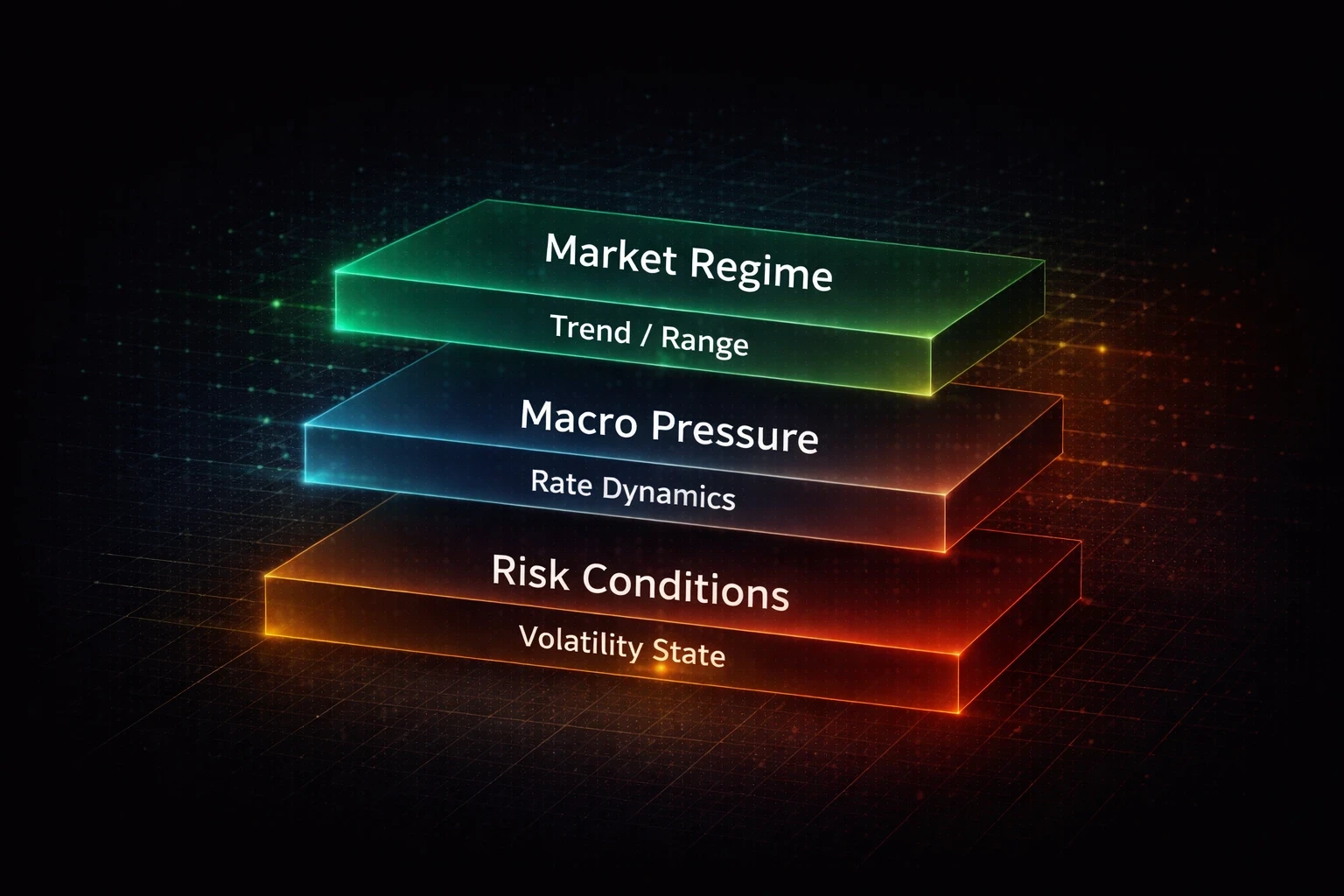

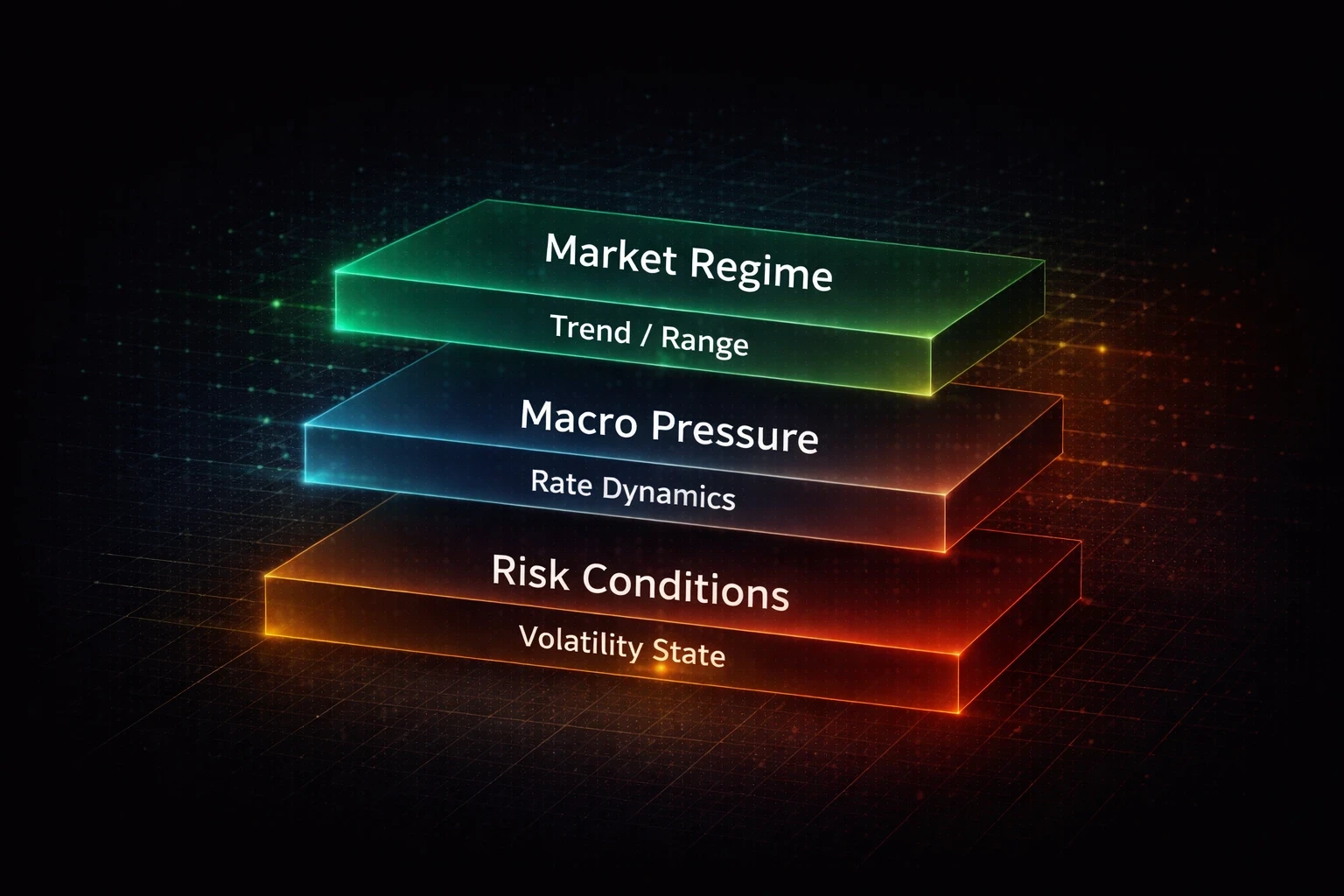

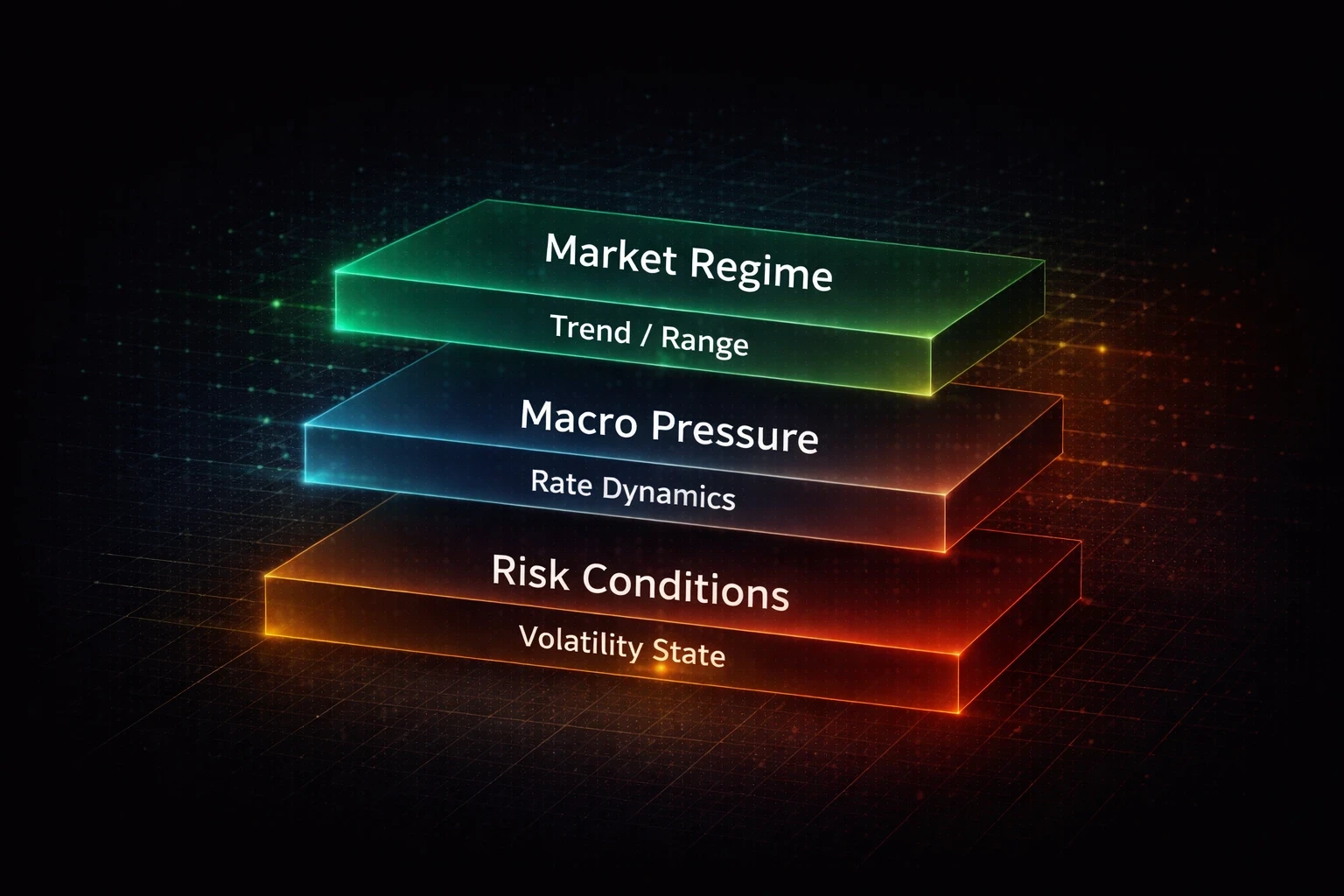

RiskCurve provides

RiskCurve provides

multidimensional market view by synthesizing macroeconomic context with multi-timeframe deep learning.

Our models identify regime shifts and directional pressure by analyzing the structural forces driving the market, prioritizing long-term robustness over short-term price noise.

multidimensional market view by synthesizing macroeconomic context with multi-timeframe deep learning.

Our models identify regime shifts and directional pressure by analyzing the structural forces driving the market, prioritizing long-term robustness over short-term price noise.

RiskCurve provides

multidimensional market view by synthesizing macroeconomic context with multi-timeframe deep learning.

Our models identify regime shifts and directional pressure by analyzing the structural forces driving the market, prioritizing long-term robustness over short-term price noise.

Market Regime

Market Regime

Market Regime

Trend/Range/Transition

Trend/Range/Transition

Trend/Range/Transition

Directional bias

Directional bias

Directional bias

Momentum sustainability

Momentum sustainability

Momentum sustainability

Macro Pressure

Macro Pressure

Rate & yeild dynamics

Rate & yeild dynamics

Rate & yeild dynamics

Institutional positioning

Institutional positioning

Institutional positioning

Cross-asset risk signals

Cross-asset risk signals

Cross-asset risk signals

Risk Conditions

Risk Conditions

Volatility state

Volatility state

Volatility state

Sessions behavior

Sessions behavior

Sessions behavior

Statistical trade permission

Statistical trade permission

Statistical trade permission

How It Actually Works…

How It Actually Works…

How It Actually Works

RiskCurve does the heavy lifting by blending complex macro trends and chart data into a single, easy-to-read map of market risks.

RiskCurve uses LSTM models to understand how market conditions evolve over time, which is crucial because trading success depends on recognizing when patterns persist and when they change.

RiskCurve does the heavy lifting by blending complex macro trends and chart data into a single, easy-to-read map of market risks.

Stay informed on RiskCurve

Sign up for early access

Stay informed on RiskCurve

Sign up for early access

Stay informed on RiskCurve

Sign up for early access

How RiskCurve models market regimes

Deep learning is used to model market structure and risk — not to generate buy or sell signals.

How traders use RiskCurve

RiskCurve sits above your strategy — filtering when it should be active.

How RiskCurve models market regimes

How RiskCurve models

market regimes

Deep learning is used to model market structure and risk — not to generate buy or sell signals.

How traders use RiskCurve

RiskCurve sits above your strategy — filtering when it should be active.

API for market regime and volatility context

API for market regime and volatility context

API for market regime and volatility context

Access market context programmatically through our trading risk management API:

Access market context programmatically through our trading risk management API.

API-first (JSON)

API-first (JSON)

Multi-timeframe: weekly → daily → intraday

Multi-timeframe: weekly → daily → intraday

Dashboard planned

Dashboard planned

Access market context programmatically through our trading risk management API:

API-first (JSON)

Multi-timeframe: weekly → daily → intraday

Dashboard planned

Your Questions, Answered

Your Questions, Answered

Your Questions, Answered

Find everything you need to know about RiskCurve in this section

Find everything you need to know about RiskCurve in this section

Is RiskCurve a trading signal service?

What problem does RiskCurve solve?

How is this different from indicators?

Does RiskCurve predict future prices?

Is RiskCurve a trading signal service?

What problem does RiskCurve solve?

How is this different from indicators?

Does RiskCurve predict future prices?

Is RiskCurve a trading signal service?

What problem does RiskCurve solve?

How is this different from indicators?

Does RiskCurve predict future prices?

Who is RiskCurve built for?

How do traders use RiskCurve?

Is RiskCurve a trading bot?

Will RiskCurve be affordable for retail traders?

Who is RiskCurve built for?

How do traders use RiskCurve?

Is RiskCurve a trading bot?

Will RiskCurve be affordable for retail traders?

Who is RiskCurve built for?

How do traders use RiskCurve?

Is RiskCurve a trading bot?

Will RiskCurve be affordable for retail traders?

Ready to take control of your trading?

Help shape RiskCurve and get early access as we validate the product. Early access users influence features and pricing.